Accounting & Advisory

We add value by being a key business partner.

Business Advisory

We take care in understanding our client’s objectives before establishing an appropriate business strategy.

We assist our clients in being proactive about change by addressing performance issues quickly. We don't just look backwards at historical figures for compliance, we look forward to ensure tax concessions and operational efficiencies are optimised.

Advali has a team of experienced professional consultants well equipped to ensure that any changes to your business are managed effectively. We evaluate projects in light of the company’s overall strategic objectives and utilise the latest technology and methodologies to deliver a timely result. We also recognise the value adding synergies of providing a full suite of services to our clients so we have close business partner relationships with other key service providers in areas such as finance, marketing, legal and IT.

Our Services

-

Annual financial reports

Bookkeeping

BAS preparation

Self-managed super funds

-

Accounting software setup and support

Xero migrations

Payroll

POS and payment services

Inventory tracking integrations

eCommerce

-

Business valuations

Financial analysis

Restructuring advisory

Business acquisitions

Financial dashboards

Export market development grants

Corporate secretarial services

IP registrations

-

Tax structure formations

Capital Gains Tax

R&D tax rebates

Tax returns

GST & PAYG

Payroll tax

FBT

Valuations & Analysis

We provide valuation and analysis services which are simple to understand

Business valuations and financial analysis services are seemingly related, however, they are typically offered in isolation in today’s market. Valuations are typically provided in the context of an upcoming transaction (such as the sale of a business, or a finance application) and financial analysis is generally aimed at improving business performance.

The primary reason for the separation of these two services is due to the fact that most business valuation methods (for example, earnings multiples) cannot be directly linked to key business performance indicators (such as return on assets).

How do we resolve this?

To resolve this issue, we have developed a model that provides a notional business value and the key drivers impacting that value. We believe it is important for management and shareholders to understand how business performance is impacting business value. Owners with growth plans, or who are reaching retirement will benefit from understanding the true value of their business and how to increase that value.

The process

Advali Analysis provides a monthly automated report that includes a valuation; and financial analysis that links the changes in business value to key financial performance indicators in the areas of profit, assets, cash and debt.

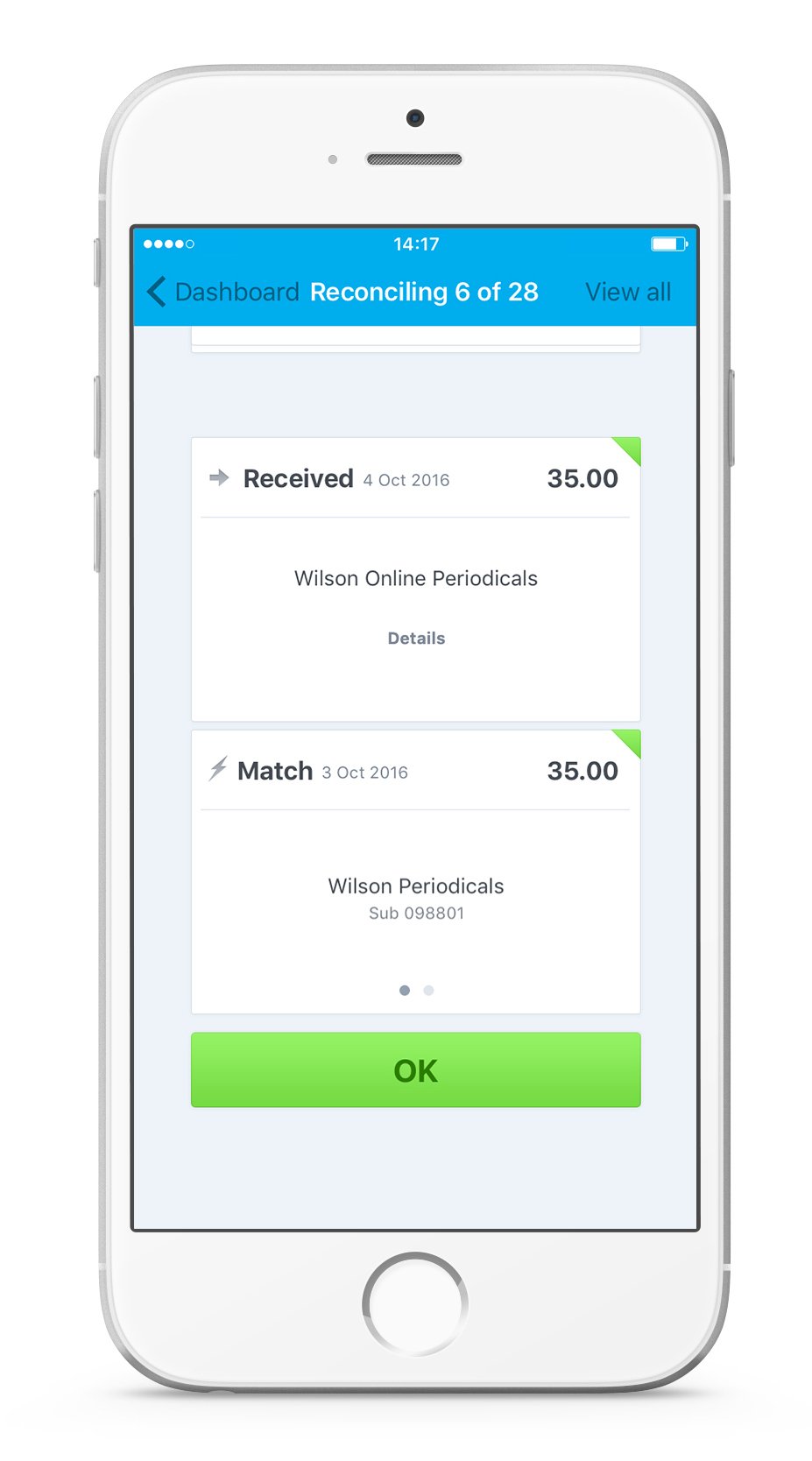

Xero business solutions

We are a Xero Gold Partner with all the tools to accelerate your business performance.

We want to help you and your business grow. Our partnership with Xero helps us achieve this goal by providing a world leading financial administration cloud platform for your business.

Xero is business accounting software that runs in the cloud. This means that all your financial data is stored online – so you can access it anywhere, anytime, from any device with an internet connection.

The Xero accounting application was designed specifically for SME businesses. It’s easy to use and will save you incredible amounts of time, transforming the way you run your business. Business owners say they find using Xero fun.

Cloud accounting

Cloud-based accounting systems like Xero run in real-time, which means your data is always kept up-to-date. There’s only one version of it, so you can connect from the office, at home or on-the-go, no more being tied to your desktop.

Collaborate online

Xero uniquely provides a single platform enabling better communication with our clients, as we can view and share the same client information at the same time. No more sending large, out-of-date files back and forth, and no need for either party to upgrade software just to be compatible.

Our clients can setup various levels of financial data access by simply individualising staff and consultant login privileges. By working collaboratively, in real-time, we are able to proficiently use financial information to assist our clients in making good business decisions.